Monthly Mortgage Talk With “My Mortgage Guy” Kurt…

I’m excited to bring you a monthly update on the mortgage market with my favorite and only mortgage professional Kurt Branstetter. Kurt has personally assisted me with several mortgage transactions and always gives it to me straight.

Here’s what he has to say about the current market conditions, but in a nut shell DON’T WAIT any longer:

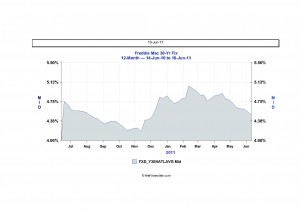

Mortgage rates continue a “friendly” trend and have moved to their best levels of 2011 (30 year fixed rate loans under 4.50%!).

As stocks moved lower for a sixth consecutive week, investors move money to the safe haven of fixed rate asset (treasury bonds and mortgage-backed securities).

Typically, fixed rate assets move very slowly but rates have improved from 4.875% to 4.375% since April 11, 2011 which is great news for homebuyers and current homeowners. A homeowner with a $400,000 mortgage at an interest rate of 5.25% would save more than $2,000/year in mortgage interest by refinancing to 4.75% with NO CLOSING COSTS today!

Homeowners should take advantage of what the market offers if they qualify because rates could spike at any time with a rally in stocks. If looking to purchase a new home, your timing appears to be excellent for getting the lowest mortgage rates in 50 years!

Is QE 3 (Quantitative Easing) on the way? Quantitative Easing is a fancy phrase for “the government printing money”. The government has used this strategy twice(thus, QE 3) in an effort to keep money flowing and to keep rates low. Be careful what you wish for…

Although QE 3 would likely boost stock prices, it would likely be troubling for mortgage rates because it would bring another round of uncertainty to the financial

markets.

If you have any questions regarding mortgages, please e-mail kurt@wjbradley.com or call him at (858) 657-1063.